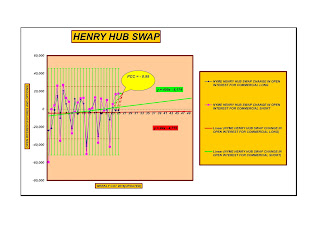

In the last 3 weeks there was a total number of new short swap contracts opened(39,613) for natural gas vs a net number of old long swap contracts closed(788) for this commodity.Besides, I got a PCC = - 0.99 for short OI and long OI for this commodity in the last 3 weeks and this means a huge divergence between bearish sentiment(rising) and bullish sentiment(falling) in this span of time.As result I expect price of natural gas to fall in the coming days/weeks.Check out my startegy and trackrecord2016 file on my free websites:http://futuresandoptions.wix.com/cotswingcharts

http://cotreportfreeswingcharts.my-free.website/My bullish vs bearish opinions/signals and charts on this blog or social networks are not a recommendation to buy, hold or sell securities.You need to do your own research when it comes to investing your money because there is no foolproof algorithm or strategy that can assure you a profit.You can only lower your risk of trading by getting more and better information.By following up my blog posts you will find out which securities have the highest vs lowest risk of trading.

Saturday, 25 June 2016

Saturday, 18 June 2016

Coffee

My latest bearish signal for price of coffee was last week on 11 June 2016 when the number of long contracts closed was 4,836) vs the number of new short contracts opened was 2,709(bearish sentiment).This week the bearish sentiment for coffee got even stronger with the number of old long contracts closed of 11,594(an increase of 239,7%) vs the number of new short contracts opened of 4,924(an increase of 181,8%).In addition,this week I got a PCC = -1 for coffee for the last 3 weeks and this means an extreme divergence between bullish(falling very fast) and bearish (rising very fast) sentiment.Therefore I keep my sentiment very bearish for price of coffee which is expected to fall in the coming days.Check out my strategy and trackrecord2016 file on my free websites:http://cotreportfreeswingcharts.my-free.website/

http://futuresandoptions.wix.com/cotswingchartsSoybean oil

My latest bullish signal for the Soybean oil was on 28 May 2016.Since then price of this commodity went up by 1.27%.This week I got a bearish signal for the Soybean oil based on the total number of old long contracts closed(12,845) vs net number of new short contracts opened(8,241) in the last 2 weeks.Moreover I also got a PCC = - 0.96 for this commodity in the last 4 weeks and this means a huge divergence between bullish(falling) vs bearish(rising) sentiment for this commodity.As result I expect price of Soybean oil to drop in the coming days/weeks.Check out my strategy and trackrecord2016 file on my free websites:

U.S. 2 Year Treasury Notes

My latest bullish signal for the U.S. 2 Year Treasury Notes was on 28 May 2016.Since then this Treasury Notes went up 0.54%.This week I got a bearish signal for the U.S. 2 Year Treasury Notes based on the number of new short contracts opened(89,283) vs the number of old long contracts closed(97,393).This is a bearish sentiment for this Treasury Notes and I expect its quote to drop in the coming days/weeks.Check out my strategy and trackrecord2016 file on my free websites:http://cotreportfreeswingcharts.my-free.website and http://futuresandoptions.wix.com/cotswingcharts

Saturday, 11 June 2016

Coffee

My last bullish signal for coffee was 2 weeks ago on 28 May 2016.Since then price of coffee went up 13.2%.This week I got a bearish signal for this commodity based on the number of new short contracts opened(2,709) vs number of old long contracts closed(4,836).This means that bearish investors are taking control of price of coffee again.Therefore I expect price of this commodity to drop in the next days/ weeks.Check out my strategy and trackrecord2016 file on my free websites:

http://cotreportfreeswingcharts.my-free.website/ and http://futuresandoptions.wix.com/cotswingcharts

http://cotreportfreeswingcharts.my-free.website/ and http://futuresandoptions.wix.com/cotswingcharts

Wheat hrw

This week I got a bearish signal for the wheat hrw based on the total number of new short contracts opened(10,867) vs total number of old long contracts closed(2,639) in the last 2 weeks.Besides I got a bearish PCC = - 0.96 for this commodity in the last 3 weeks.This means a huge divergence between bearish(rising) vs bullish(falling) sentiment for this commodity in the last 3 weeks.As result I expect price of the wheat hrw to drop in the coming days/weeks.Check my strategy and trackrecord2016 file on my free websites:http://futuresandoptions.wix.com/cotswingcharts and http://cotreportfreeswingcharts.my-free.website/

Wheat srw

This week I got a bearish signal for the wheat srw based on the total number of new short contracts opened(37,745) vs net number of old short contracts closed(368) in the last 2 weeks.Besides I got a bearish PCC = - 0.63 for the wheat srw in the last 3 weeks.This means a srtong enough divergence between bearish(rising) and bullish(falling) sentiment for this commodity in the last 3 weeks.Therefore I expect price of wheat srw to drop in the coming days/weeks.Check out my strategy and trackrecord2016 file on my free websites:http://cotreportfreeswingcharts.my-free.website/

http://futuresandoptions.wix.com/cotswingcharts

http://futuresandoptions.wix.com/cotswingcharts

JPY/USD

This week I got a bearish signal for the JPY/USD ratio based on the total number of new short contracts opened(16,794) vs net number of old long contracts closed(2,107) in the last 2 weeks.Moreover I got a bearish PCC = - 0.91 for the Japanese Yen in the last 3 weeks.This means a huge divergence between bearish(rising) and bullish(falling) sentiment for this currency in the last 3 weeks.Therefore I expect JPY/USD ratio to drop in the next days/weeks.Check out my strategy and trackrecord2016 file on my free websites:

http://futuresandoptions.wix.com/cotswingcharts and http://cotreportfreeswingcharts.my-free.website/

http://futuresandoptions.wix.com/cotswingcharts and http://cotreportfreeswingcharts.my-free.website/

NZD/USD

This week I got a bearish signal for the NZD/USD ratio based on the total number of new short contracts opened(7,430) vs total number of new long contracts opened(1,670) in the last 2 weeks.This means new short contracts opened outnumbered new long contracts opened by more than 4 to 1.This is bearish and as result of this I expect NZD/USD ratio to drop in the next days/weeks.Check out my strategy and trackrecord2016 file on my free websites:http://cotreportfreeswingcharts.my-free.website/

http://futuresandoptions.wix.com/cotswingcharts

http://futuresandoptions.wix.com/cotswingcharts

GBP/USD

My latest bearish signal for GBP/USD ratio was on13 February 2016.Since then this ratio dropped by 1.38%.This week I got a bullish signal for GBP/USD based on the total number of new long contracts opened(5,134) vs net number of old short contracts closed(17,589) in the last 3 weeks.Besides I got a bullish PCC = - 0.96 for the British pound in the last 3 weeks.This means a huge divergence between bullish(rising) and bearish(falling) sentiment for this currency in the last 3 weeks.Therefore I expect GBP/USD ratio to rise in the next days/weeks.Check out my strategy and trackrecord2016 file on my free websites:http://futuresandoptions.wix.com/cotswingcharts

http://cotreportfreeswingcharts.my-free.website/

http://cotreportfreeswingcharts.my-free.website/

Wheat hrs

My second bullish signal for Wheat hrs was last week on 4 June 2016 when its spot price was 359.50.This week spot price of Wheat hrs was 358.50 so it means it dropped by 0.19%.But my first bullish signal for wheat hrs was on 16 April 2016 when spot price of Wheat hrs was 523.50.This means that spot price of Wheat hrs since then went up 2.87%(check my trackrecord2016 file).This week I got a bearish signal for Wheat hrs based on the number of new short contracts opened(1,818) vs number of old long contracts opened(1,012).I expect price of Wheat hrs to drop in the next days/weeks.Check out my strategy on my free websites:http://cotreportfreeswingcharts.my-free.website/

http://futuresandoptions.wix.com/cotswingchartsSunday, 5 June 2016

Platinum

This week I got a bullish signal for Platinum based on the total number of new long contracts opened(1,879) vs total number of old short contracts closed(8,152) in the last 2 weeks.Besides I got a Pearson correlation coefficient(PCC) = - 0.82 for this commodity for the last 3 weeks.This means a strong divergence between bullish(rising) vs bearish(falling) sentiment in the last 3 weeks.Therefore I expect price of Platinum to rally in the next days/weeks.Spot price of Platinum on 3 June was 981.90.Check out my strategy on my free websites:http://futuresandoptions.wix.com/cotswingcharts vs http://cotreportfreeswingcharts.my-free.website/

Saturday, 4 June 2016

Wheat hrs

My latest bullish signal for Wheat hrs was on 16 April 2016 when its spot price was 523.50 and it had a PCC = - 0.98.Since then price of this commodity went up 3 %.This week I got a new bullish signal for Wheat hrs based on the total number of new long contracts opened(1,010) vs total number of old short contracts closed(2,868) for the last 2 weeks.Moreover I also got a PCC = -0.80 for this commodity for the last 3 weeks.This means that there is still a very strong divergence between bullish vs bearish sentiment with bullish investors in control of price of this commodity.As result of what I said I expect price of Wheat to keep rising in the coming days/weeks.Spot price of Wheat hrs on 3 June 2016 was 539.50.Check out my strategy on my free websites:http://cotreportfreeswingcharts.my-free.website/

Subscribe to:

Comments (Atom)